Acquisition Project | CirclePe

Product Selected: CirclePe Club

What is CirclePe? (Elevator Pitch)

"Ever felt frustrated paying a massive security deposit just to rent a home? What if you could move in without one?"

At CirclePe, we’re making renting deposit-free for tenants while ensuring upfront payments for landlords. It’s a win-win—renters keep their cash, and landlords get peace of mind. Backed by marquee and leading investors, CirclePe is on a mission to revolutionize renting for 170+ million urban Indians. Think of us as the UPI of renting—seamless, Instant, and stress-free. Ready to Rent Smarter? Join us at CirclePe and say goodbye to Security Deposits forever!

Why CirclePe? (Reasons to Use)

Problem Statement For Tenants :

- High Upfront Costs 💰

"Moving into a new home is expensive, and security deposits—often 6 to 10 months’ rent—tie up hard-earned money that could be used elsewhere." - Locked & Inaccessible Money 🔒

"Security deposits remain locked with landlords for years, earning zero interest and often leading to disputes when trying to get it back." - Unfair & Non-Standard Practices ⚖️

"There’s no standard rule—some landlords demand excessive deposits, making housing unaffordable and stressful for renters." - Cash Flow Challenges 🔄

"Young professionals and students struggle with liquidity. A massive deposit blocks their ability to manage other essential expenses." - Risk of Losing Deposits ❌

"Many tenants face unfair deductions or outright refusal when reclaiming their deposit at the end of a lease."

Problem Statement For Landlords :

- Delayed & Uncertain Rent Payments ⏳

"Landlords depend on security deposits as a financial safety net, but collecting rent on time is still a challenge." - Tenant Defaults & Move-Out Risks ⚠️

"If a tenant leaves unexpectedly or defaults, recovering unpaid rent or damages from them is difficult." - Legal & Administrative Hassles ⚖️

"Managing deposits, refunds, and disputes over deductions leads to unnecessary legal and administrative headaches." - Limited Trust & Verification 🔍

"Landlords hesitate to rent out their properties due to trust issues—background checks are often manual and unreliable." - Slow Property Turnaround 🔄

"When tenants struggle with deposits, they delay moving in. This leads to vacant properties and lost rental income for landlords."

Has CirclePe Achieved PMF?

Yes, CirclePe has achieved PMF and reasons are as follows

1: 20000+ Users Onboarded & Using the Product

2: Customers have reached the AHA Moment

3: Testimonials & Reviews on the App store and Play Store.

Objectives of User Research :

To Understand Acquisition Channels, Their Pain Points and Desires, and the Typical Journey of Renting a Apartment

Actual Interviews

These are the actual interviews conducted among my family, and colleagues who are currently renting a flat in Bengaluru. Also conducted an Interview with my Landlord to understand his perspective on the security deposit and if he would use CirclePe.

Interview 1: Rahul Shah & Aastha Agarwal. (Mid Level Professionals)

(Though they are currently staying in an owned house, this Interview is mostly based on their experience of renting in New Delhi and Bengaluru.)

Some Background: Rahul and Aastha are a married couple who moved to Bengaluru from New Delhi in 2019 for better job opportunities. Rahul is currently working in Zepto as D2C Partnership Director & Aastha in Google Pay as Product Marketing Head.

Question 1: What challenges were you facing when you decided to relocate to Bengaluru?

Rahul: When we decided to relocate, the first thing we looked for was a 2/3 BHK apartment near our office in Bellandur. Searching for apartments in Bengaluru while sitting in New Delhi was quite a challenge.

We trusted the NoBroker app and found a few listings that matched our requirements. But one thing that really bothered me was the security deposit. None of the landlords were willing to accept anything less than 10 months' rent as a deposit. Apparently, this was the norm in Bengaluru.

Back in Delhi, we were used to paying only six months deposit, which we were comfortable with. But here, the expectation was 10-12 months, which felt like a big financial burden."

Question 2: What was the rent, and how much security deposit did you have to pay?

Rahul: In Bellandur, we rented a 3BHK apartment for ₹52,000 per month. The landlord required a security deposit of ₹5,20,000—which was 10 months' rent upfront."

Question 3: How was your experience with the landlord when you wanted to move out?

Rahul: So, Bengaluru has another strange norm—when moving out, you’re either required to repaint the apartment at your own expense or the landlord deducts one month’s rent from your deposit to cover the cost.

We decided to get the apartment repainted ourselves, which cost us ₹30,000. A few days after we vacated, we received our remaining security deposit."

Question 4: If a product like CirclePe had existed in 2019, would you have used it?

Rahul: Absolutely, without a doubt!

The ₹5,20,000 we had to lock up as a security deposit could have been better utilized—for relocation expenses, interiors, or even investments. If I had put that money into equities, I would have earned better returns instead of letting it sit idle for months.

Interview 2: Pooja Farswan and Pavneet Kaur (Early Career Professionals)

Some Background: Pooja and Pavneet work as a Brand Executive and Social Media Manager at Sumadhura. They’ve been living in Bengaluru for over a year and earn around ₹35,000 per month. Previously they were staying in a PG and moved to a rented 2BHK 3 months back.

Question 1: What challenges are you facing with your current PG accommodation?

Pooja: When I first moved to Bengaluru, staying in a PG felt like the most convenient option. I was adjusting to a new job and an unfamiliar city, so it made sense at the time.

But over time, it started feeling too restrictive—no late-night entries, boring meals, and zero privacy. I realized I needed a place where I had more control over my own space. That’s when we started looking for a 2BHK apartment near the office.

Question 2: How was your journey and experience in finding a 2BHK?

Pavneet: We were looking for a semi-furnished 2BHK in a decent society, preferably in Bellandur or Marathahalli, since we didn’t want to live too far from the office.

For me, the most important thing was flexibility and comfort—having my own space, being able to cook whenever I wanted, and not having to worry about PG rules.

First, we asked a few colleagues and friends if they knew of any available flats. At the same time, I started looking on NoBroker.

The rent seemed reasonable, around ₹15,000 to ₹20,000 per month, but the security deposits were ridiculous—most landlords were asking for ₹2 to ₹2.5 lakh upfront!

I tried negotiating, but none of them budged. In the end, we had to use our savings, which we had originally set aside for travel, just to pay the security deposit."

Question 3: If you had known about CirclePe, would you have used it?

Pooja: "1000% YES! If we had known a service like CirclePe existed, we definitely would have used it.

Pavneet: Honestly, I wish we knew an option like this existed—it would have saved us from compromising on our plans."

Interview 3: Rikin Jain & Ritika Jain (Newly Married Couple Looking for a Rental Apartment in Bengaluru)

Some Background: Rikin is a Chartered Accountant working in a tech company in Yelahanka. Before getting married, he was staying at his brother’s place, so he never had to worry about rent or PG accommodations. Last year, he got married to Ritika, an IT professional from Hyderabad. After marriage, they decided to rent an apartment and move in together.

Question 1: What made you decide to rent your own apartment instead of continuing at your brother’s place?

Rikin: Living at my brother’s place was convenient—I never had to think about rent, deposits, or landlord issues. But once Ritika and I got married, we wanted our own space. We needed a place where we could set up our own home, have privacy, and create a routine that worked for both of us. Plus, my brother’s house was a bit far from her office, so moving made sense for both of us."

Question 2: How was your experience finding a rental apartment in Bengaluru?

Ritika: It was way more stressful than I expected! I had just moved from Hyderabad, so I wasn’t familiar with the rental market here. We wanted a 2BHK, semi-furnished, close to Whitefield, but every listing we found had one major issue—the security deposit.

Most landlords were asking for 10 to 12 months' rent as a deposit. For a flat that was ₹35,000 per month, that meant around ₹3.5 to ₹4 lakhs upfront! I was shocked. In Hyderabad, we had paid just two to three months' rent as a deposit—this was so much higher.

Question 3: Did you try negotiating the security deposit with landlords?

Rikin: Of course! I asked multiple landlords if they’d accept a lower deposit, maybe three or four months instead of ten. There were few listings which were asking for 6 months deposit but we didn't prefer them coz of our lifestyle needs.

Question 4: How did you arrange for the security deposit?

Ritika: Honestly, we didn’t want to touch our savings because we were already planning for other expenses—furnishing the house, buying appliances, and setting up our life together.

But since landlords wouldn’t budge, we had to take money from our emergency savings just to pay the deposit. We were hoping to use that money for a vacation after our wedding, but instead, it got stuck with the landlord.

Question 5: If you had known about CirclePe, would you have used it?

Rikin: Without a doubt! If we had an option like CirclePe, we wouldn’t have had to block ₹4 lakhs just sitting there for a year. That money could’ve gone into investments or setting up our home instead.

Ritika: Exactly! If there was a way to pay a small fee instead of a huge deposit, we would’ve signed up instantly. I think a lot of young couples face this issue when starting out—it’s a huge expense that no one talks about until you start looking for a place.

Summary & Inferences from the ICP Interviews

Parameter | ICP 1 | ICP 2 | ICP 3 |

|---|---|---|---|

Names | Rahul & Aastha | Pooja & Pavneet | Rikin & Ritika |

Age | 34M & 32F | 24F and 25F | 29M & 27F |

Location | Bellandur | Maratahalli | Whitefield |

Did they Relocate to new City? | Yes, both from New Delhi in 2019 | Yes from different cities | Yes, Ritika relocated from Hyderabad |

Financial Income & Status | Mid-level professional, earning well but affected by high deposits | Early Career Professionals. | Stable dual-income, CA & IT professional, comfortable but financially conscious |

Decision Making Factors | Wanted an apartment near the office; NoBroker helped, but high deposits were a deal-breaker | PG was convenient initially but lacked flexibility and privacy; wanted an affordable 2BHK | Needed their own space post-marriage, close to work, and financially reasonable |

Pain Points | Huge security deposit (Rs.5.2L for a 52K rent), high move-out costs, repainting deductions | PG Restriction and High Security Deposit. | Unrealistic Security Deposit. Had to use their emergency funds. |

Financial Mindsets | Prefers liquidity; would rather invest than keep money locked in a security deposit | Struggles with balancing affordability; wants flexibility but also needs financial stability | Planned finances well but had to compromise savings meant for home setup and travel |

Trust and Security Concerns | Worried about long refund delays and landlords deducting unfair charges | Concerned about not getting deposits back in full; prefers a structured system | skeptical about landlord fairness |

Desires | Better cash liquidity, wants money for investments or home setup | Wants flexibility, freedom, and privacy in a rented apartment | Wants to set up a new home without exhausting savings |

Hobbies & What do they like? | Investing, traveling, exploring new business ideas | Hanging out with friends, occasional travel, content creation | Traveling, home decor, watching financial & lifestyle content |

ICP Prioritization

Criteria | ICP 1 | ICP 2 | ICP 3 |

|---|---|---|---|

Adoption Curve | Low | Low | Low |

Appetite to Pay | High | Medium | High |

Frequency of Use Case | Medium | High | Medium |

Distribution Potential | Medium | High | Medium |

TAM | Medium | High | High |

Reasoning for Prioritization of ICP 2:

ICP 2 (Pooja & Pavneet) are young professionals who have low adoption curve (As they are Tech enthusiasts and Open to exploring new things). They have high-frequency usage (They move between rentals more than others). They have High Distribution Potential and TAM (A large early professional population in Bengaluru actively seeks rental alternatives.)

Understanding Core Value Proposition

1️⃣ No Need for a High-Security Deposit

- Instead of locking ₹2-5L in a security deposit, tenants can move in without paying a large lump sum.

- Helps tenants free up cash for other important expenses (home setup, travel, investments, etc.).

2️⃣ Financial Flexibility & Liquidity

- Renting has become more affordable because people don’t have to liquidate their savings just to pay a deposit.

- Enables users to allocate funds better—pay rent monthly without worrying about large upfront costs.

3️⃣ Faster & Hassle-Free Move-Ins

- No need to wait for weeks to arrange a huge deposit.

- Tenants can secure apartments quicker compared to traditional methods where landlords demand upfront deposits.

4️⃣ Guaranteed Protection for Landlords

- CirclePe provides a company-backed guarantee to landlords, assuring them that they’re covered.

- This reduces the risk for landlords while also benefiting tenants.

5️⃣ Transparent & Fair Refund Process

- Tenants don’t have to chase landlords for refunds when moving out.

- No more unfair deductions for repainting, maintenance, or other hidden costs.

6️⃣ Digital & Convenient Process

- No need for paperwork-heavy agreements—everything is handled online.

- Secure transactions with easy digital verification.

How Zero Security Deposit Works?

Step 1: ICP's first find and finalize their Apartment to rent (Via various Portals or other methods)

Step 2: ICP's download the CirclePe app and connect their new landlord with CirclePe's team

Step 3: CirclePe team briefs Landlord about Club Benefits as follows :

1: Advance rent of 10 Months

2: 1 Month Security Deposit

3: Property Management

4: New Tenants on every renewal

Step 4: Once the Landlord agrees to Join, CirclePe pays the agreed amount to the Landlord and the Tenant can move in into their apartment without having to worry about a security deposit.

Step 5: Tenant/ICP pays their monthly rent via the CirclePe app with some additional platform fees.

Step 6: When Tenant plans to moves out, CirclePe checks for any damages or dues and collects the same from Tenant before exit.

What are the Charges for Tenant & Landlords?

Tenant: 3-4% of Platform fees is added to their monthly rent.

Landlord: get advance rent of the entire lease at a 2-2.5% discount.

For Example:

Monthly Rent = ₹10,000/-

Lease for Delhi NCR = 8 months.

Lease for other cities = 10 months.

For Tenant:

Monthly rent as No-Cost EMI: ₹10,000 + 4% Platform fees = ₹10,400/-.

For Landlord:

For Delhi NCR: Advance rent of entire lease: 80,000 (₹10,000 x 8) - 2.5% discount fees = 78,000 + 1 Month's rent as Security deposit.

For Other Cities: Advance rent of entire lease 1,00,000 (₹10,000 x 10) - 2% discount fees = 98,000 + 1 Month's rent as Security deposit.

Why Does This Work for Everyone?

For Tenants:

✔ Saves lakhs of rupees upfront.

✔ No deposit stuck for years—cash stays liquid.

✔ No stress about getting the refund back.

✔ Faster move-ins without waiting to arrange a deposit.

For Landlords:

✔ Guaranteed financial protection from CirclePe.

✔ No risk of tenants not paying rent or causing damage.

✔ CirclePe handles disputes & deductions, making the process smoother.

Competitor Research:

Though there are currently No direct competitors offering similar service, there are other Indirect competitors or Alternatives which our TG could use or prefer to use.

| Competitor | Problem Solved | Target Audience | Pricing Model | Competition with CirclePe |

|---|---|---|---|---|

Co-Living Spaces (Zolo, Stanza, Colive) | No deposits, fully furnished, short-term flexibility | Young professionals, digital nomads | Monthly rent with services, no/low deposits | Direct competition as they offer a deposit-free model with added services |

Institutional Rental Housing (BTR) (Grexter, Settl, CoHo) | Managed long-term rentals, professional property management | Mid-to-high income professionals, corporate employees | Higher rent, lower/no deposit, long-term leases | Competes on stability & structured renting but higher-end |

PGs & Traditional Hostels | Budget housing, meals & utilities included | Students, freshers, low-income workers | Lower rent & deposits (1-3 months), food included | Competes on affordability but lacks flexibility & privacy |

Market Trends :

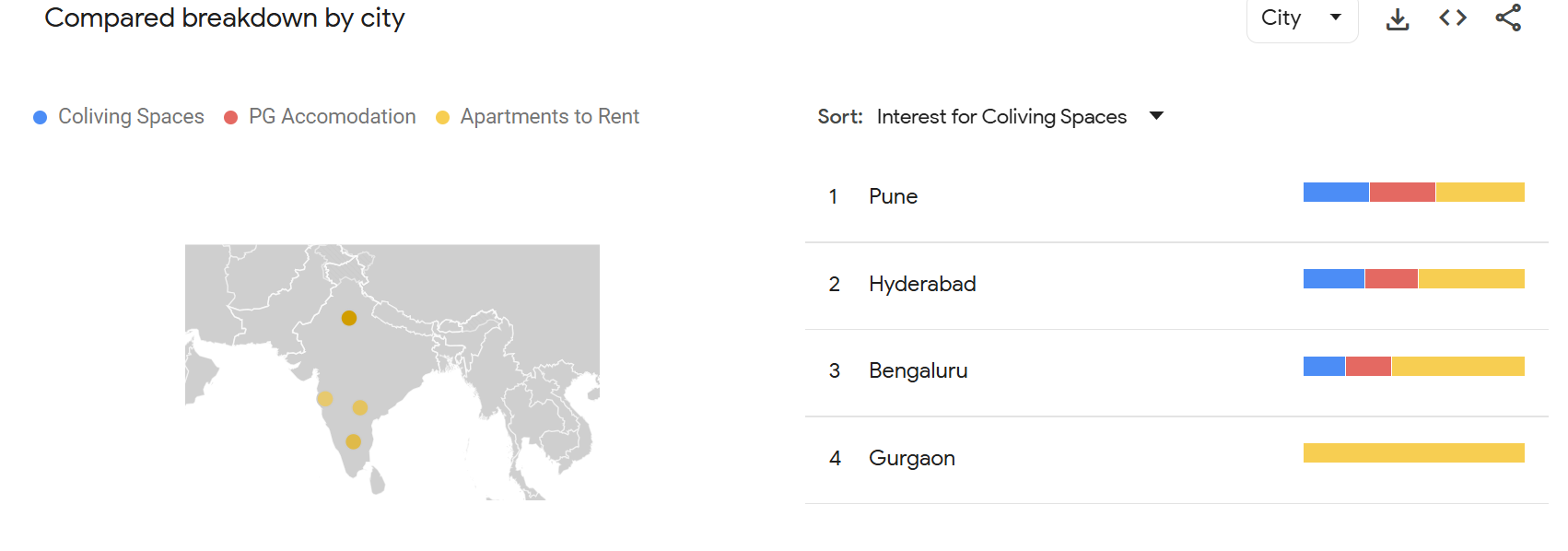

A Simple Comparison of the search trends among the Indirect competitions for a year shows Trends for Rental Apartments is higher than Co-living Spaces and PG Accommodation.

The trend for Apartments to rent is higher in Gurgaon and Bengaluru. Where for markets in Pune & Hyderabad there is an equivalent trend for Co-living and PG accommodation.

Estimated TAM, SAM, and SOM :

Method Used for Deriving the Estimates - Top-Down Model

Before we get into the above estimates, let's take a look at Existing Revenue Model of CirclePe.

For Example -

If a Tenant rent ₹20000 Per Month Apartments for 10 Months

He pays Platform fee of ₹6000 (20000 x 10 x 3% )

Landlord pays ₹4000 (200000 x 2%) ((Advance Rent Discount Revenue)

Total Revenue for CirclePe = ₹10000 Per Lease

If CirclePe Onboards 10000 tenants - 10000 x 10000 = 10 Crores per lease cycle

If CirclePe Onboards 1 Lakh tenants - 100000 x 10000 = 100 Crores per lease cycle.

Now Coming to our Required Estimates of TAM, SAM and SOM

We are using the formula:

Revenue Potential=Total Number of Potential Customers × Average Revenue Per Customer (ARPU)

where ARPU = ₹10,000 per lease cycle.

Total Addressable Market

Total Population of India - 140 Crores

People who prefer renting - 42 Crores (Source - NoBroker)

TAM Revenue Potential - 42Crores X 10000 = 4,20,000 Crores ( 4200 Billions)

Serviceable Available Market

SAM Customers = TAM × 30% (CirclePe’s Target Market)

SAM Customers = 12.5 Crores

SAM Revenue Potential - 12.5Crores X 10000 = 1,25,000 Crores

Serviceable Obtainable Market

SOM Customers = SAM × 50% (Tier 1 City Focus Market)

SOM Customers = 6.25 Crores

SOM Revenue Potential - 6.25Crores X 10000 = 62500 Crores

Designing Acquisition Channel

As CirclePe is in the Early Scaling Stage - The Objectives are to acquire users quickly, Build Trust, and establish a predictable Growth Loop.

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low | High | Medium | Slow | High |

Paid Ads | High | High | Low | Fast | Medium (Depends on Budget) |

Referral Program | Medium | High | Medium | Fast | High (If Viral loops Works) |

Product Integration | Medium | Medium | High | Medium | Medium |

Content Loops | Low | High | High | Slow | High |

Content Creator → Who creates the content? 👨💻

- CirclePe’s marketing team

- Existing users (via referrals/testimonials)

- Influencers & partners

- Happy landlords & tenants (UGC - user-generated content)

Content Distributor → Who will distribute the content? 📢

- CirclePe’s official social media & website

- Email campaigns & WhatsApp marketing

- Influencers & brand ambassadors

- Users sharing referral links

- Blog posts, case studies, and PR articles

Distribution Channels → Where will content be shared? 📡

- Social Media (Instagram, Facebook, X, LinkedIn, WhatsApp)

- Referral Program & Community Shares

- Email & Push Notifications

- SEO Content (Blog, FAQs, How-To Guides)

- Influencer Collaborations

- Tenant & Landlord Testimonials

Type of Content Loops & Their Flow

Below are the 2 Types of Content Loops which I think will generate more engagement

1️⃣ Viral Referral Loop

- How It Works: Users sign up → Have a great experience → Share referral link → New users sign up → Cycle repeats.

- Why It Works for CirclePe: Every time a new user signs up, they’re incentivized to refer more people, fueling organic growth.

2️⃣ User-Generated Content (UGC) Loop

- How It Works: Users share success stories, reviews, and testimonials → This builds trust → New users see social proof and sign up → They create more content.

- Why It Works for CirclePe: Positive stories about zero deposits & rent savings encourage others to try the platform.

Knowing CAC to LTV Ratio

Before investing in paid ads, it’s important to check if the cost to acquire a customer (CAC) is justified by the long-term value (LTV) of a customer.

Formula:

CAC : LTV Ratio= Customer Acquisition Cost (CAC) ÷ Customer Lifetime Value (LTV)

1️⃣ Estimating Customer Lifetime Value (LTV)

LTV Formula:

LTV=ARPU X Average Customer Lifetime

- ARPU (Average Revenue Per User per lease cycle): ₹10,000

- Average Customer Lifetime (How many lease cycles they stay with CirclePe): 2 lease cycles

- LTV Calculation: LTV=₹10,000×2=₹20,000

2️⃣ Estimating Customer Acquisition Cost (CAC)

- Let’s assume Paid Ads CTR = 3%, and Conversion Rate = 5%

- Cost Per Click (CPC) Estimate:

- Google Ads: ₹20 per click

- Facebook Ads: ₹15 per click

- To get one conversion, CirclePe needs:

- 100 clicks → 5 conversions (5% conversion rate)

- Cost per conversion = (100 clicks × ₹20) / 5 = ₹400 per customer

3️⃣ Calculating CAC:LTV Ratio

₹400 : ₹20,000= ₹0.02

Since a healthy CAC:LTV ratio is around 1:3 (0.33), CirclePe’s ratio of 0.02 is highly profitable, meaning paid ads are viable. ✅

Ideal Customer Profiles (ICP) for Paid Ads

🎯 ICP 1: Young Working Professionals (23-35 years)

✔ Pain Point: Paying high-security deposits locks their cash.

✔ Desire: Keep savings for travel, investments, or living expenses.

✔ Platform to Target: Google Search (High Intent), Facebook & Instagram (Awareness, Conversion (App downloads), Retargeting)

🎯 ICP 2: Newly Married Couples (25-35 years)

✔ Pain Point: Just moved in together and don’t want to lock up savings in a security deposit.

✔ Desire: More financial flexibility while securing a good rental home.

✔ Platform to Target: Google Search (High Intent), Facebook & Instagram (Engagement, Visual Appeal & Social Proof).

Advertising Channels Focused on Google Ads and Meta Ads

To efficiently capture and convert users, we will focus on:

Deep Dive Into Targeting Strategies Per Platform

Each platform requires a unique targeting strategy to ensure high ROI.

Google Search Ads – Targeting High-Intent Keywords

Google Ads will focus on users actively searching for deposit-free rental solutions.

Top Keyword Variants to Target

To optimize Google Ads, we will segment keywords based on search intent.

| Keyword Type | Example Keywords |

|---|---|

Transactional (High Intent – Ready to Convert) | Apartments to Rent, 2/3BHK for Rent |

Informational (Medium Intent – Researching Options) | How to rent a house without deposit?, alternative for rental deposit, Best rental schemes in India. |

Competitor-Based (Targeting alternative solutions) | Stanza Living, Co-living Places, Yellow Co-Living, PG near me etc. |

Brand Keywords (High Intent) | CirclePe , CirclePe Benefits, CirclePe Reviews, CirclePe Coupons |

Targeting Strategy for Google Ads:

✔ Location Targeting: Tier 1 cities (Bengaluru, Mumbai, Delhi, Pune, Chennai, Hyderabad)

✔ Audience Intent: People searching for rental properties in these locations

✔ Device Preference: Mobile-first (Most rental searches happen on mobile)

Google Discovery Ads – Targeting Interest Groups

In-Market Audience - Users ready to take action

Residential Properties for Rent – Actively searching for rental homes

📌 Property Rental & Lease Services – Comparing rental options

📌 Credit & Loan Seekers – Interested in rent payment financing

📌 Moving & Relocation Services – Planning to shift homes soon

Interest & Affinity Audience - Ongoing Interest related to Housing, Fintech and Rentals

📌 Real Estate & Rental Seekers – People searching for homes

📌 Financially Conscious Consumers – Users looking for rent savings & EMI options

📌 Personal Finance & Credit Improvement – Interest in credit score benefits

📌 Young Professionals & Relocation Seekers – Job changers, students moving to cities

📌 Expats & Digital Nomads – Looking for hassle-free renting

📌 Tech-Savvy & Online Users – Engaged with fintech, property tech apps

Custom Intent Audience - Hyper-Targeted

Google lets you create custom intent audiences based on search behaviors and website visits. This is powerful for targeting users actively researching rental options.

YouTube Ads - Hyper-Targeted

Just like Google Discovery Ads, YouTube Ads can leverage targeted audiences to drive highly engaged renters & landlords to CirclePe through compelling video ads.

Meta Ads – Targeting Parameters

Since users don’t actively search for rental solutions on Meta, we will target them based on interests & behaviors.

➡️ Interest & Behavioral Targeting

- Demographics:

- Age: 23-35 years (Working professionals & young couples)

- Location: Bengaluru, Mumbai, Delhi, Pune, Chennai, Hyderabad

- Interest-Based Targeting:

- Rental housing platforms (NoBroker, MagicBricks, Housing.com)

- Life Events: People who recently moved or got married

- Financially Conscious Users (People engaging with finance & savings content)

- Retargeting:

- People who visited CirclePe’s website but didn’t sign up

- Users who engaged with previous ads but didn’t convert

➡️ Lifestyle & Aspirational Targeting

- Age Group: 23-35 years

- Location: Tier 1 Cities

- Interest-Based Targeting:

- Real estate & rental pages

- Finance & savings-related content

- Moving or relocation interest

- Lookalike Audience Targeting:

- Users who have engaged with rental listings, brokers, and real estate content

➡️ Lookalike Audience

We will use our best-performing audiences by targeting new people who resemble our existing high-value users.

Start with a 1%-2% Lookalike of converted users → Scale gradually if performance remains strong.

➡️ Remarketing Audience

These ads are crucial for converting users who showed interest but didn’t complete the journey.

Below are the audience bucket whom we will use for retargeting

- High Intent Website Visitors - Users who visited key pages but didn’t complete sign-up

- Incomplete Registrations - People who entered details but didn’t finish signing up

- Engaged Social Media Users - People who liked, commented, or shared ads but didn’t sign up

Marketing Pitch Strategy As Per Platform & Audience

Each platform requires a unique pitch strategy to match the user’s intent and engagement behavior.

Google Search Ads – Capturing High-Intent Renters

- Goal: Target people actively searching for rental solutions in India.

- Ad Format: Text-based Search Ads

- Message Focus: "Move In Without Paying a Security Deposit."

Google Ad Copy Example:

Headline: "Rent a Home Without a Security Deposit – CirclePe"

Description: "Why waste ₹2-5L on security deposits? With CirclePe, move in hassle-free & keep your savings intact!"

CTA: "Sign Up Now & Rent Smarter!"

Meta & Google Discovery Ads

| Audience Type | Primary Message | Key Benefits | Call to Action (CTA) |

|---|---|---|---|

High-Intent Audience | Skip the Deposit, Move in Today | Zero deposit homes, No-cost EMI, ₹500 off first rent | Download CirclePe & Start Renting Now |

Lifestyle & Behavior Audience | Renting Made Simple for Your Urban Lifestyle | Flexible payments, No security deposit, Hassle-free moving | Find a Zero-Deposit Home Today |

Lookalike Audience | Did You Know? You Can Rent Without a Deposit | No financial burden, Better rental options, Credit score boost | Learn More & Claim ₹500 Rent Discount |

Remarketing Audience | You’re One Step Away from Zero Deposit Renting | Complete sign-up, Flexible rent payments, Hassle-free renting | Finish Sign-Up & Unlock Your Benefits |

Do they Have Existing Referral Plan?

No, As per my research I didn't find any existing Referral offer or plan on the app. No mention of Referral on the Homepage or Profile Page.

AHA Moment and Referral Touch Point

Here's a Visual of how the AHA Moment will be experienced.

Customers will experience the AHA Moment once the first transaction is done successfully.

Bragging Point

For CirclePe the Bragging Point will be the amount saved by not paying Security Deposit

For eg: I Just Moved into my Apartment with Zero Security Deposit 🤩

Platform Currency

For CirclePe Users Money / Points is the best motivation.

Introducing Circle Points

For eg: For each successful referral - CX will earn up to 500 Circle Points

These Circle Points can be redeemed against the Platform fee when paying the next monthly rent.

Customers can Increase their Circle Points via Gamification & Leaderboards.

Whom to Ask for a Referral?

1: Colleagues working with them

2: Friends looking for Rented Apartment

3: Family or Friends relocating to a New City

Referral Discovery

Customers will discover about Referrals through the below touchpoints.

1: App Notifications

2: In App Banners on Home & Profile Page

3: Email Notifications

4: SMS Notifications

5: WhatsApp Notifications

6: Social Media Posts

Referral Sharing & Communication

How Users Can Share Referrals:

- Social Media: Pre-generated posts with Personalization and clear Value Proposition. A referral link to be attached for automatically attributing the successful signups to the Referer for WhatsApp, X, Instagram, and LinkedIn.

- Email: Users can just put in a Referre's Email address and Click on Submit. Referee would get a personalized Email with CirclePe Invitation and Benefits.

Copy - "Hey { Referee First Name} Get your next rental home without a deposit! Join CirclePe using my link and earn ₹500 (Circle Points) bonus!"

Tracking Referrals

Tracking Mechanism:

- Referral Dashboard: A section where users see the status of their referrals.

- Progress Indicators: Display how many friends have signed up & completed actions.

- Success Notifications: Inform users when a referral is successful.

- Add a progress bar showing how close users are to their next reward.

Key Elements of the Referral Landing Page

Objective : The referral landing page should be simple, visually engaging, and persuasive

- Compelling Headline – Grabs attention immediately.

Eg Copy - "Move In With ₹0 Deposit – Special Invite From [Referrer’s Name]!"

- Clear Value Proposition – Why should they join CirclePe?

Eg Copy - Save BIG on Rent Deposits – Say goodbye to hefty security deposits!

✅ Instant Approvals – Move in without financial stress.

✅ Boost Your Credit Score – Pay rent & improve your credit history.

✅ Exclusive Welcome Bonus – Get ₹500 OFF your first rent payment!

Referral Benefit Section – What do they and the referrer get?

Eg Copy - ✅ You Get: ₹500 towards your first rent payment

✅ Your Friend Gets: ₹500 as a thank-you bonus

✅ It’s a Win-Win! No security deposit, just seamless renting.

Limited Offer: Sign up today and double your reward!

Claim Your Bonus Now [CTA Button]

Simple Sign-Up CTA – Easy one-step registration.

- "Join Now & Get ₹500 Off Your Rent!"

- "Start Renting Without a Deposit – Sign Up Now!"

- "Claim Your Bonus – Move In Hassle-Free!"

Social Proof & Trust Builders – Reviews, testimonials, or credibility badges.

⭐ Rated 4.8/5 by thousands of happy renters!

🏆 Backed by leading investors like iSeed, Venture Catalysts & more

💬 “CirclePe made moving into my dream home effortless. No deposit, no stress!” – A happy user

👉 Join thousands of renters who’ve ditched deposits forever!

FAQ Section – Answers common questions to remove doubts.

Encouraging Continuous Referrals

Ways to Boost Long-Term Engagement:

- Tiered Rewards: The more referrals, the higher the benefits (e.g., 1 referral = ₹500, 5 referrals = ₹3,000).

- Bonus Incentives: Surprise rewards when users reach certain milestones.

- Referral Challenges: Monthly leaderboard contests where top referrers win bigger prizes.

- Limited-Time Offers: Urgency-driven campaigns (e.g., "Refer 3 friends before the 10th and earn ₹1,000 extra!").

That's All ✅

Thank You for your time. 😊

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.